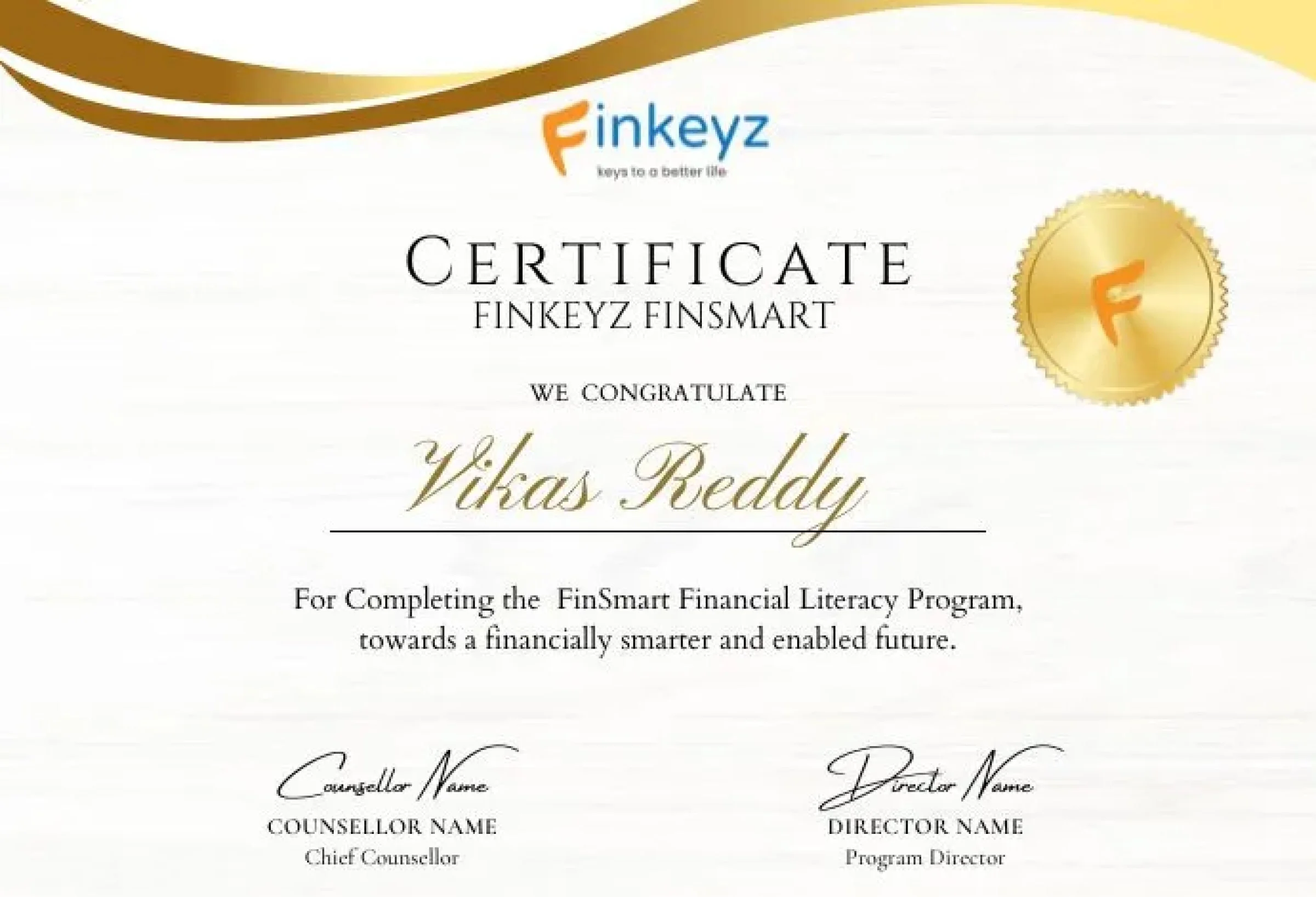

At Finkeyz 360, we prepare your child for a smarter financial future through our FinSmart program. Developed by parents who are alumni from IIM Ahmedabad, NPCI, Goldman Sachs, and KPMG, our live financial literacy sessions makes learning about finance enjoyable and practical for kids and teens.

Money management is the topmost cause of stress in adults worldwide

Most adults wish they had learned finance earlier – as kids.

Early financial education sets the foundation for a secure future.

Financially secure life = Stress-free life

Concept of money and its evolution + basic concepts of taxation, spends, savings, investment, wealth ...

How banks function and make money for themselves & account holders. Simple & compound interest, credit debit cards...

Why is insurance needed, and the types of insurance needed by us. Oh, and what if everyone claimed insurance ...

What are micro & macro-economics and their roles in our day-to-day lives. Why is economics important to understand...

Various thumb rules and concepts around budgeting, investing, financial planning and debt management...

One of the most complex (creative to some) part of finance. What are assets, and what are liabilities? What is a balance sheet, a P&L statement...

... most popular are stocks/equities and fixed income investments? What is a Mutual Fund? Let's try it out ourselves, shall we?

Say, what's the risk of keeping all your eggs in one basket? Oh, what is risk in the first place? All your money can't be in one place...

Not all money really exists in physical form. Electronic Money, Wallets, Blockchain & Cryptocurrencies! It's crazy - a never-ending money evolution around us.

Besides Equities & Fixed Income, where could one look at avenues for wealth growth, keeping in mind the risk-reward ratios.... let's see...

The Internet comes with its own sets of risks! While dealing with money, learn about the dos & don'ts of safe online behaviour - financial & otherwise.

The final takeaway of it all. Money is a tool and a means, not a goal by itself.

Covers: Level A Modules

Practical and Relatable Projects, Quizzes & Assignments

Covers: Level A, Level B, Level C Modules

Practical and Relatable Projects, Quizzes & Assignments

Hands on learning with real life practical projects and research.

Children are able to initiate their financial journeys early which reaps dividends over the long term.

Recover your investment through practical projects .

Get free membership to Finkeyz Student Clubs and for select programs.

Parents are welcome to join and learn alongside children (Live sessions).

Ensure we are all aligned on your child's progress (Live sessions).

"Very Innovative"

"Finkeyz is really helping him."

"Amazing Concepts"

Financial skills positively impact various aspects of a student’s life:

Don’t just settle for a job that pays the bills. Creating wealth is the key to a better financial future. Most people who start their financial journey later in life lack smarter financial approaches, miss out on opportunities, and struggle with money management. Don’t be a late-starter and miss out on the power of compounding! Financial wisdom develops over time with knowledge and practice. Start early and create a better quality of life for yourself.

Remember, time is of essence! Don’t wait to regret not having financial skills later in life. Invest in yourself now and create wealth for a better future!

You can think of FinSmart STEP UP as a comprehensive program on financial literacy and wealth management, with a special focus on enabling your financial journey.

While it does cover investment concepts, it also covers other financial concepts that are essential for building a strong foundation in personal finance. FinSmart STEP UP can help you gain practical financial skills and apply them in real-life situations. So, it’s much more than just a course on investing!

If you have taken Personal Classes and at any time post first 5 sessions, you feel that STEP UP is not the program you’re looking for, we will refund your money back. The refund would be proportional to the total number of sessions taken until then, including the demo and any absent sessions. If you have taken the discounted group classes however, refund is not available. This is to ensure that your pullout doesn’t affect classes for your other group members. The refund would be processed to your account within 5-7 working days.

We are sure that FinSmart STEP UP will be fun and a worthwhile investment for you.